A budget is an important part of financial well-being. Knowing your monthly income and expenses creates mindfulness around your money. If you want to take control of your cash flow but aren’t sure where to start, we encourage you to read our budgeting guide and download our free budgeting worksheet and start managing your spending today!

Why Use a Budget Spreadsheet?

There are many budgeting methods out there: from online apps to the envelope system and beyond. What’s the best one? The answer is simple: the one that you will actually stick with. While online apps are practical, especially if they sync with your bank account, they all require a paid subscription. And the truth is, there’s little that you can’t do on your own on a spreadsheet. Before you purchase any app membership, download the Savvy Ladies easily customizable and free spreadsheet. You’ll also receive a printable PDF version in case you prefer to track your monthly income and expenses by hand.

How to Use the Savvy Ladies Budget Spreadsheet

Use the budget worksheet to keep track of your income and expenses, check in with yourself to see how you are doing and readjust as needed. Fill the form above to receive the spreadsheet and PDF versions of the budgeting worksheet to your email for free. You can use Microsoft® Excel, Numbers on a Mac or online Google Sheets to edit it.

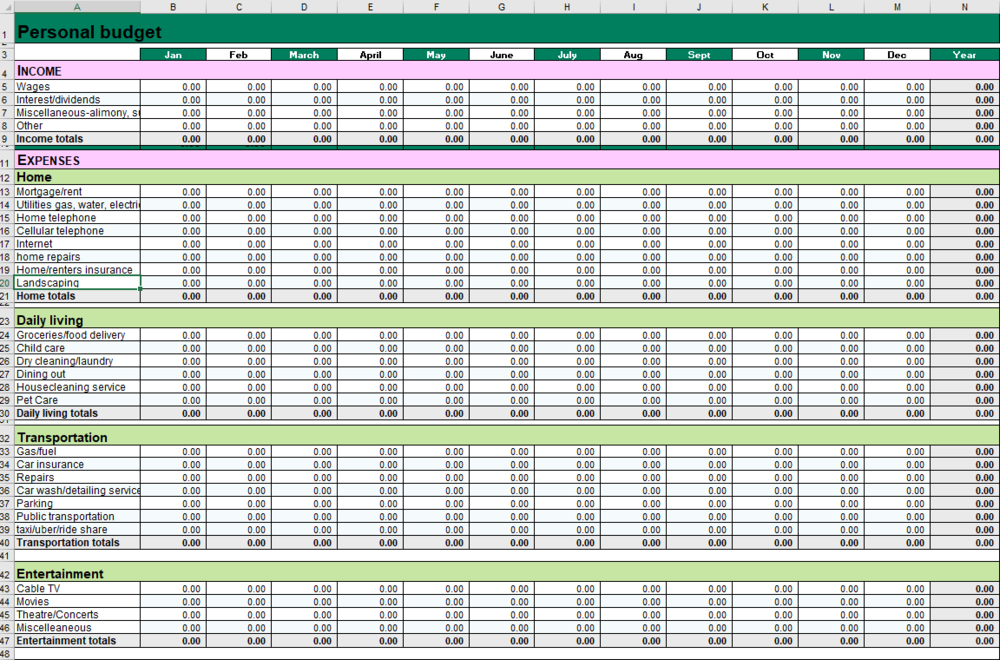

Savvy Ladies budgeting worksheet.

Filling the first column of your spreadsheet is taking the first step towards financial stability. Ready to start? Here’s how:

- Customize income and expenses categories. Review and rename, if needed, the labels in column A to personalize this budget spreadsheet to truly reflect your financial picture and to work for your lifestyle. We have included the most popular items and categories, but you can add more by adding rows under each category. The totals are automatically calculated, so you don’t have to calculate those. For more expert advice on how to break down your spending categories, read our budgeting guide.

- Input your income. Add in your disposable income at the top of the worksheet. The amount that you add on the month of January will be automatically added to the following months, assuming that income is the same monthly. If that is not the case, you can simply go month by month and adjust the numbers.

- Fill the expenses section. Input the information to the best of your knowledge. If you pay bills using your credit card(s), you can identify many of your expenses from your monthly statements. Enter each dollar amount in the corresponding category. If you don’t have the exact number for certain categories or items, feel free to use your best “guesstimate” until you have the actual information at hand. Then you can go back and revise. That way, you’ll make sure everything is accounted for.

- Review and adjust. Take a look at the very last row of the worksheet. It will tell you what’s the balance between your income and expenses, meaning how much cash you have left after all expenses are accounted for, or how much you are overspending. If your expenses are higher than your income, that number will automatically turn red. As you budget for future spending, scroll back up and see which spending categories can be adjusted so that you end up with a surplus of money. If savings are already contemplated in your budget, you can aim to always have a zero in the “Cash short/extra” cells.

Have Budgeting Questions?

The Savvy Ladies Free Financial Helpline is available to assist you and guide in with any questions you may have regarding budgeting, debt management, savings, investing. Ask your personal financial question and get matched with a Certified Financial Advisor for free. Get the financial guidance you need to help set you up for financial success, and start building your wealth plan today!

Check out our Budgeting articles & webinars for more tips to successfully take control of your money.

Do you need help understanding your credit card finance charges? Check out our calculator to learn the truth about your credit card interest.