Stacy’s Savvy Financial Advice

Stay Savvy with our founder Stacy Francis’ latest articles on financial planning, budgeting, debt management, investing, divorce, retirement planning, and more.

Stacy Francis founded Savvy Ladies® in 2003 with the mission to educate women about their finances and empower them to make proactive choices. Inspired by her grandmother who stayed in an abusive relationship due to financial reasons, Stacy has been determined to never let another woman become powerless by financial instability.

Get the resources, knowledge, and tools you need to make smart and informed decisions about your money and your life.

In addition to being the Founder and Board Chair of Savvy Ladies®, Stacy is the President, CEO of Francis Financial, Inc., a boutique wealth management and financial planning firm. A nationally recognized financial expert, she holds a CFP® from the New York University Center for Finance, Law, and Taxation, and is a Certified Divorce Financial Analyst® (CDFA®), a Divorce Financial Strategist™ as well as a Certified Estate & Trust Specialist (CES™).

Stacy has appeared on CNBC, NBC, PBS, CNN, Good Morning America, and many other TV & Financial News outlets. Stacy too is ofter sought out for her advice and can be found quoted in over 100 publications such as Investment News, The New York Times, The Wall Street Journal, USA Today. She shares her wisdom and expert financial advice here for you to learn and get savvy about your finances.

Financial Knowledge is Power. Be Empowered and Find the Advice You Deserve.

Know that Savvy Ladies® is here for you! Should you like to seek advice on a personal financial question, please visit our Free Financial Helpline and get matched with a pro bono financial professional, click here.

STACY’S $AVVY ADVICE

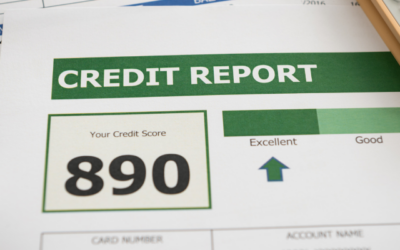

Top 6 Tips for Improving Your Credit Score

By Stacy Francis, CFP®, CDFA

According to myFICO, it’s important to note that repairing bad credit is a bit like losing weight: It takes time, and there is no quick fix. In fact, out of all of the ways to improve a credit score, quick-fix efforts are the most likely to backfire, so beware of any advice that claims to improve your credit score fast.

Here are some of the top tips to raise your score.

- Pay down balances and pay off all outstanding debts. A main ingredient in the credit score formula, the size of your balances really does matter. Pay them down – or even better, off. Here’s more advice on paying off credit card debt.

- Protest unfair information. If you have an entry on your credit report that shouldn’t be there (honestly, now), know that you can dispute it. If you submit complaints to the company that posted it as well as the credit-reporting agency, they will investigate and take it off, leaving your record a whole lot cleaner.

- Contact creditors. Write letters to creditors explaining any payments that were more than 60 days late. Request that the creditor share that information with the credit companies. If you’ve been a loyal customer for years and normally make your payments on time, chances are, if you talk to customer service, they will disregard that one time you forgot to pay your bill because you were on your honeymoon. Ask politely – and thou shall receive.

- Don’t neglect the oldies. Another important factor in the credit score formula is how long your accounts have been open. So even if the Victoria’s Secret card you applied for when you were in college doesn’t have the most useful perks, use it once in a while for a credit score boost.

- Cancel any credit cards or department store cards that you don’t use. Be sure to put the cancellation in writing so the account will show you canceled it versus the credit card company.

- Pay your bills on time. It seems simple, yet so many people fail on this count. If you have a hard time remembering your payments, set up a reminder.

Be careful about tainting your good credit with debt incurred by someone else with lower credit quality than you, such as a new spouse. Help your partner clean up his or her credit before you begin co-signing on additional credit.

Removing Incorrect Entries from your Credit Report

Many people don’t know that if you feel an entry on your credit report has been put there in error, you can complain in writing to the credit-reporting agency (meaning that if this certain record has been reported to all three agencies, you need to send letters to each one of them separately). The agency then advises the company that put the entry on your record about your complaint, and it has thirty days to respond and strengthen its case. If it fails to do so, the reporting agency removes the entry from your record.

This may sound like a “so what?”, but the truth is many companies are so overwhelmed, if your entry is minor enough (or complicated enough), chances are, they won’t think it’s worth their time to fight your claim. I know many people who have used this technique to improve their credit histories – and thus their futures. It only takes a few letters, and the most it’ll cost you is a couple of stamps.

So next time the thought of spending hours on the phone trying to cut through layers of bureaucracy makes you cringe, try this alternative approach and throw the bureaucracy right back at them!

READ ALSO: What You Need to Know About Credit

Do you have any financial questions? Contact the Savvy Ladies Free Financial Helpline today and get free mentoring from a financial advisor.

What You Need to Know About Credit

By Stacy Francis, CFP®, CDFA

You sit down in your mortgage broker’s office because you can’t stand the news. Your credit is so bad you will not be able to secure a loan to buy the dream home you just bid on. Can you imagine? After months of taking time off work to run from one open house to the next, you forgot to check your credit report to make sure your credit was in order. What independent credit reporting agencies say about you and your credit can and will make the difference between your ability to buy a car, a house, or even a simple pair of shoes.

Your credit report contains everything about your credit history, including the good, the bad, and the ugly. Details you would never dream of sharing with even your closest of friends are listed neatly for all creditors to see. Your last residence, your employment history, your bill payment history, how many credit cards you have, how much you owe, and how much access to credit you already have are just a few of the juicy details contained within your report.

How Your Credit Score Affects Your Finances

Every time you apply for a new card, your credit score goes down. This can affect your finances in many more ways than you would think. Below are just a few.

- The lower your credit score, the more expensive it is to finance anything – from your dream home to that sweet new car. When you have a low credit score, banks and similar institutions consider you a high-risk individual, so if you want a mortgage, be prepared to pay for it.

- A low credit score can make it expensive at best, impossible at worst, for you to get a loan, should disaster strike.

- It might make it harder to lease a place. Many landlords will only lease their apartments or houses to people in good to excellent credit standing.

- You may need to put down a deposit – lock your money up without earning any interest – even for things as ordinary as, say, cell phone service.

- Your credit score may cost you that job you want — most notably any type of position where you work with money, be it in a bank or another type of financial institution.

So what hurts your credit?

Paying bills late, defaults on loans, too many credit cards, canceling your credit cards, large balances, medical bills that were lost in an insurance shuffle can all end up creating black marks on your credit report.

Many major life events, such as marriage and divorce, purchasing a home, or having a child are also financial changes that involve and can affect your credit.

Many credit files contain inaccuracies that can harm your credit rating. Just as reviewing your credit card statement can reveal charges you did not make, reviewing your credit report can reveal activity on accounts you don’t use or new accounts you did not open, alerting you to the possibility of identity theft.

FICO 8: Credit Scoring System

Even the most responsible borrowers slip up sometimes. Maybe a utility bill went unpaid after you moved and the missed payment went into collections. Or perhaps there are unpaid library fines or parking tickets in collections that are hanging on to your credit history and affecting your FICO credit score, which is widely used by lenders to evaluate your ability to repay debt.

With the newest version of the FICO credit scoring system, however, minor delinquencies are now overlooked in calculating credit worthiness.

Under the updated scoring model, called FICO 8, small missed payments lingering in collections with original amounts of $100 or less will no longer do damage to your credit score.

Consumers also are less likely to be penalized for any single delinquency if it occurred two or more years ago- and if their credit history is otherwise unblemished. There’s more flexibility with missing a payment. If you have a more habitual pattern of paying accounts late, you’re more likely to get penalized for that.

If a consumer’s credit usage is high, that will be more likely to hurt his or her score with FICO 8. But getting close to your credit card limits- even if you always pay on time- is penalized in some way in every FICO score, not only the recent edition.

Finding and Understanding Your Credit Score

There are three major credit-reporting agencies: Experian, Equifax, and TransUnion. The information on their reports tends to vary slightly. You can get your credit report for free from www.annualcreditreport.com

Once you have your reports, you should check them for accuracy. If you see anything that shouldn’t be there, make sure you contact the reporting agency/agencies to dispute it.

Looking at your reports for the first time can be something of a cold shower, as they will list every single late payment you have ever made in your life, as well as how late it was.

The actual score is a snapshot of your creditworthiness at any given time. It is calculated by a machine, and influenced by many factors such as available credit, outstanding debt, length of credit history, and late payments. As these variables vary, so does your score. So the good news is that when you clean up your report, make your payments on time, and reduce your outstanding debt, over time your credit score will be better and better.

Correcting Mistakes in Your Credit Report

Few Savvy Ladies know that they can fight an improper charge on their credit card. The Fair Credit Billing Act, which was passed in 1974, makes sure the law is on your side. In fact, your credit card company is required to investigate and either correct the mistake or explain why the bill is correct within 90 days. They must acknowledge your complaint within 30 days.

Make sure to put your complaint in writing and send it via certified mail to “Billing Inquiries,” which is listed on the back of your card statement. According to the law, your dispute letter must include your name, address, account number and a description of the problem. Visit Bankrate.com for a sample dispute letter to help you on your way. The deadline for notifying your credit card company of a billing error is 60 days from the date the bill was mailed to you. Keep in mind that the 60-day clock starts ticking on the day your issuer mails your billing statement, not the date you receive it. So by the time you receive your bill, you actually have 50-odd days to get a dispute letter back to your card issuer.

Request your free credit report online or by calling 1-877-322-8228. You can also contact any of the following “big three” credit reporting agencies: Equifax, Experian, or TransUnion.

Different Types of Debt: Which Should I Pay Off First?

By Stacy Francis, CFP®, CDFA

At a recent get-together at my parents house, one of their friends was excited to tell me his company had given him a substantial bonus – one that far exceeded his expectations. Thrilled to have a financial expert at the party, he asked whether I thought he should invest the money, or use it to pay down debt.

This is a brilliant question, and one that is fairly simple to answer. It depends on the cost of your debt, as well as the return on the investment you are considering. Some types of debt, like credit card debt, are expensive, so if you have them you should definitely use the money to pay them off. I know it sounds boring, but you will be happy later, when financing charges stop eating half your paycheck.

Other types of debt, such as student loans and mortgages, tend to have fairly reasonable rates and long payback times. Hence, you may be better off investing the money than paying them off. Say, for instance, that you pay 6% interest on your mortgage, and the yield from the investment you would like to try is 8%. In this case, depending on what kind of risk comes with the potential investment, you may be able to walk away with an extra 2% per year if you invest the money rather than dumping it into your home.

As all the debt my parents’ friend had was a low-interest mortgage, he decided to invest the money – after treating himself to a cruise with his wife. After all, life’s supposed to be lived. As for you, next time you come across a larger-than-expected sum of money, compare rates. The answer to this question is simply mathematical.

Types of Debt, From Worst to Best

My parents’ friend is far from the only one having a hard time keeping different types of debt apart. With this in mind, here’s a list of different types of debt, starting with the kinds you want to lose right away and ending with the types you may actually want to keep.

- Credit card debt. Don’t do it, and if you have already done it, pay it back and never do it again. It’s that simple.

- Loans against your 401(k). These are nowhere near as bad as credit card debt, but losing them will enhance your financial health significantly.

- Auto loans. As long as you can afford your monthly payment without any problems, you can keep this type of debt.

- Home equity loans/second mortgages. This loan type should be paid off before you consider losing the categories below.

- Student debt. Student loans tend to be pretty favorable – pay them off after the types above, but before you consider making a dent in your mortgage.

- Mortgages. Interest rates are generally favorable for mortgages, making it more important to contribute to 401(k) plans and other types of retirement savings accounts than paying off your mortgage.

How Much Debt is Too Much?

Debt is truly a widespread problem these days. So with each of my clients who are trying to regain control of their money, I usually start out by breaking down their finances – income, costs, spending, and debt. In many cases, their debt-to-income ratio comes out higher than the limits most lending institutions use when determining how large a mortgage an individual can carry. According to them, if your debt payments (including mortgage payments) eat up more than 36% of your gross income, you should consider changing your lifestyle. If you do not own a home, of course your debt payments should be much smaller than that. Still, many people are far deeper in debt.

The good news is, by taking an honest look at your finances, drafting a budget, and making changes – some smaller, some bigger – you can turn this around and face a brighter financial future. I see it happen all the time. All you need is determination and a network of people who support you.

Take debt management courses (and other financial literacy classes) for free! Sign up for the Savvy Ladies Financial Knowledge Program here.

Use Affirmations to Attract More Money!

by Stacy Francis, CFP®, CDFA

14 Money Affirmation tips from Stacy Francis, Founder Savvy Ladies

So you desire to have a more rich and rewarding life? One of the most effective ways to do this is by harnessing the life-changing power of prosperity affirmations. When you are emotionally connected to your desire for more wealth and happiness you can use the power of affirmations to see how quickly your need is manifested!

Affirmations are very powerful tools for transformation and self-empowerment. If you intend to bring anything new and positive into your life, monitoring and control of your thoughts and words are very important.

Use of your daily financial affirmations will help you to be more loving and positive toward yourself and others at all times, in every situation. Listen to your heart, and know that as you learn and grow, you will not only transform yourself in a positive way but will attract prosperity into your life!

Use the following power prosperity affirmation for attracting money.

Prosperity Financial Affirmation: Money comes to me easily and effortlessly.

Tips on Using Prosperity Financial Affirmations

- Give up all negative talk about yourself or any others. If the dialogue is internal, use your affirmation. If it is from an external source, say something positive, or simply smile and walk away from the conversation.

- Stay in the now. Forget the past. Forget the future. They don’t exist.

- Repeat the affirmation out loud and/or to yourself as often as possible throughout the day.

- Sing the affirmation – in the shower, in the bath, in your car, to your children.

- Write it out 50 or 100 times – whatever you have time for.

- Get some post-it notes and stick them on your computer as you work. Better yet, change your screen-saver every day!

- Place it on your bathroom mirror.

- Place it in your wallet or in your purse.

- Place it beside you as you drive your car.

- Keep the radio off and repeat the affirmation on your way to and from work.

- Record it on a tape and play it in your vehicle as you drive.

- Create a large corkboard and get some thumbtacks and plenty of sheets of colored paper. Each day, write your affirmation down on the paper and tack it to your corkboard. Make it interesting by cutting out different shapes – like hearts or diamonds or spirals, or even ladders with rungs… Very soon, you will have a rainbow of colors and shapes on your corkboard, filled with colorful, positive affirmations.

- Journal your affirmations. Write down your experiences. Write down your dreams. Share them with others who are doing this with you.

- Stay positive!

Originally published April 25th, 2014

Fixed vs. Variable Expenses: What’s the Difference?

by Stacy Francis, CFP®, CDFA, Founder Savvy Ladies

Perusing the annual report of a company that I am invested in, I got to thinking about how these two words are so much more than just accounting jargon. They affect your financial future to a much greater extent than you may think. So let’s break them down and look at what fixed and variable expenses are – and aren’t.

What Are Fixed Expenses?

Fixed expenses are all reoccurring expenses – from rent or mortgage bills to car payments as well as tuition or childcare expenses for your children. Other bills that fall under this category include health insurance, life insurance, and essential utilities. We typically do not pay much attention to these costs, but most of our budget goes toward funding them.

These fixed expenses occur repeatedly and typically can’t be dropped with a moment’s notice, should your financial situation change. Therefore, it is essential to make sure that your fixed expenses are as low as possible, allowing you ample funds for variable costs that are often harder to control and savings. Fixed costs should take up no more than 50% of your income to make sure that you have enough breathing room in your cashflow.

Examples of Fixed Expenses:

- Rent

- Mortgage

- Health insurance

- Life insurance

- Car loan payments

- Tuition

- Childcare expenses

- Essential utilities

What Are Variable Expenses?

Classic examples of variable expenses are clothing, vacations, entertainment, eating out, gifts, facials, and home goods.

Many variable expenses happen sporadically only a few times a year. Think of that plane ticket you just booked to see your family in California. However, some variable costs happen every month. For example, gas, parking fees, groceries, and personal care expenses in any given month could be different from previous payments or ones you’ll make in the future.

Sporadic and ongoing variable costs can make budgeting very difficult because you never really know how much you need for this part of your monthly spending.

That being said, variable costs that can change from month to month should take up no more than 30% of your income. The positive about many of your variable expenses is that you usually have a little more control over them, and you can drop many of them if you really needed to. In addition, variable expenses are generally much easier to lower than fixed expenses like your housing.

Examples of Variable Expenses:

- Groceries

- Gas

- Clothing

- Personal care expenses

- Home goods

- Vacations

- Entertainment

- Eating out

- Parking fees

- Gifts

Savings Expenses

You might not have ever thought about savings as a monthly expense, but you should! Your goal should be to saving 20% of your income for the future. These dollars can be stashed into an emergency fund, invested in retirement, or used to kickstart your down payment savings for your first home.

If you are like most people, you struggle to save for short-term and long-term goals. According to Bankrate, one in five American adults do not save at all. Just 16 percent of those surveyed report socking away more than 15% of their income. When Bankrate asked their survey participants why they missed the mark, the top reason given was expenses. Is this the case for you too?

Fixed vs. Variable Expenses: Considerations for Your Budget

If you could use more breathing room in your budget, you should review your fixes and variable expenses, keeping the 50/30/20 rule in mind.

The 50/20/30 rule

- Fixed costs that stay the same month after month, such as your rent or mortgage, car payment, and cable bill, should take up 50% of your income.

- Variable costs that can change from month to month, such as entertainment, groceries, and clothing, should take up 30% of your income.

- Savings should take up 20% of your income.

Reviewing your fixed expenses will significantly impact how much you can save each month because they make up most of your spending. However, the negative is that reductions can be more brutal to come by and might require a change in the home you rent or own and the car you drive. More manageable fixed expenses that you can reduce can be had by changing cell phone plans, canceling extra cable channels, shopping for less expensive insurance, or refinancing your home for a lower mortgage interest rate.

The upside of having variable expenses in your budget is that you have more control over them than you do with fixed payments. It is typically easier to find opportunities to save money, but you need to think about this spending every day. If you want to save money on variable expenses, it may require some lifestyle adjustments. For example, cutting back or cutting out things like dinners or new clothes are simple ways to save. You could also save on groceries and dining out by planning meals, using coupons, or switching from name brands to generic.

Everyone deserves to splurge from time to time. But when you do – make sure you keep the 50/30/20 rule in mind. Keeping your expenses down is one of the critical factors in the quest for financial independence.

Looking to get on top of your finances? Download our free budgeting worksheet here.

Investing in uncertain times – using stocks and bonds to secure your financial future

Stacy Francis, CFP®, CDFA®, CES™ will discuss how to create financial immunity and protect your portfolio during market volatility. In her presentation, you will also learn what moves you can make to stay on the right track with your investments and retirement, and discover how you can be financially resilient in these times of uncertainty.

About Stacy:

Stacy Francis is the President and CEO of Francis Financial, Inc., a fee-only boutique Wealth Management, Financial Planning and Divorce Financial Planning firm dedicated to providing ongoing comprehensive advice for successful individuals, couples and women in transition such as divorce or widowhood. Stacy has over 20 years of experience in the financial industry. She attended the New York University Center for Finance, Law and Taxation, where she completed the Certified Financial Planner™ (CFP®) designation. Stacy is also a Certified Divorce Financial Analyst® (CDFA®) as well as a Certified Estate and Trust Specialist (CES™). Stacy has mastered specialized training in the financial issues of divorce and is the Director of the Association of Divorce Financial Planners (ADFP) Greater New York Metro Chapter.

Stacy is the founder of Savvy Ladies™, a nonprofit organization dedicated to educating and empowering women to take control of their finances. Savvy Ladies has helped over 20,000 women through free one-on-one financial counseling, workshops and retreats. Stacy also gives back as a board member of FamilyKind, a nonprofit organization offering NYC divorce services to adults and children experiencing separation or divorce.

She is a nationally-recognized financial expert being one of twenty of the nation’s leading wealth managers on CNBC’s Digital Financial Advisor Council, a member of the Forbes Finance Council as well as an expert contributor for The Wall Street Journal. Stacy’s expertise is highlighted in over 200 media publications, articles, bylined pieces and quotes. Stacy is the host of Financially Ever After, a podcast focusing on women, money and divorce. She is also the author of the white paper, Unveiling the Unspoken Truth: The Financial Challenges Women Face During and After Divorce.

Stacy has received numerous industry awards, among them, Investopedia 100 Top Financial Advisors, Investment News Women to Watch, Financial Planning Association’s Heart of Financial Planning Award, Financial Planning Magazine’s Pro Bono Award and the NAPFA Consumer Education Foundation’s first Pro Bono Award. She was also listed as a national Money Hero by CNN Money Magazine, one of the Top Wealth Advisor Moms by Working Mother Magazine and one of the best financial Advisors for women by the Women’s Choice Award. The firm has been named one of the Top 10 Best Financial Advisors in New York for 4 years in a row.

How the CARES Act Affects Your Small Business

Join us for this special conversation with Savvy Ladies Founder, Stacy Francis, CFP®, CDFA®, CES™.

Stacy will discuss how the CARES Act affects your small business. You’ll learn about the benefits, eligibility, and the application process.

About Stacy:

Stacy Francis is the President and CEO of Francis Financial, Inc., a fee-only boutique wealth management, financial planning and divorce financial planning firm dedicated to providing ongoing comprehensive advice for successful individuals, couples and women in transition such as divorce or widowhood. Stacy has over 20 years of experience in the financial industry. She attended the New York University Center for Finance, Law and Taxation, where she completed the Certified Financial Planner™ (CFP®) designation. Stacy is also a Certified Divorce Financial Analyst® (CDFA®) as well as a Certified Estate and Trust Specialist (CES™).

Stacy is the founder of Savvy Ladies™, a nonprofit organization dedicated to educating and empowering women and that has helped over 15,000 women make proactive choices about their finances. She is a nationally-recognized financial expert being one of twenty of the nation’s leading wealth managers on CNBC’s Digital Financial Advisor Council, a member of the Forbes Finance Council as well as an expert contributor for The Wall Street Journal. Stacy is the host of Financially Ever After, a podcast focusing on women, money and divorce.

Stacy has received numerous industry awards, among them, Investopedia 100 Top Financial Advisors, Investment News Women to Watch, Financial Planning Association’s Heart of Financial Planning Award, Financial Planning Magazine’s Pro Bono Award and the NAPFA Consumer Education Foundation’s first Pro Bono Award. She was also listed as a national Money Hero by CNN Money Magazine, one of the Top Wealth Advisor Moms by Working Mother Magazine and one of the best financial advisors for women by the Women’s Choice Award.

What You Need to Know about the Coronavirus and Your Money

In this special conversation with Savvy Ladies Founder, Stacy Francis, CFP®, CDFA®, CES™, we’ll discuss how COVID-19 has impacted the markets.

In this special conversation with Savvy Ladies Founder, Stacy Francis, CFP®, CDFA®, CES™, we’ll discuss how COVID-19 has impacted the markets.

Discover how you can be financially resilient in these times of uncertainty. Learn what moves you can make to stay on the right track with your investments and retirement.

Stacy will be answering your questions on how the coronavirus is affecting your financial situation.

About Stacy:

Stacy Francis is the President and CEO of Francis Financial, Inc., a fee-only boutique wealth management, financial planning and divorce financial planning firm dedicated to providing ongoing comprehensive advice for successful individuals, couples and women in transition such as divorce or widowhood. Stacy has over 20 years of experience in the financial industry. She attended the New York University Center for Finance, Law and Taxation, where she completed the Certified Financial Planner™ (CFP®) designation. Stacy is also a Certified Divorce Financial Analyst® (CDFA®) as well as a Certified Estate and Trust Specialist (CES™).

Stacy Francis is the President and CEO of Francis Financial, Inc., a fee-only boutique wealth management, financial planning and divorce financial planning firm dedicated to providing ongoing comprehensive advice for successful individuals, couples and women in transition such as divorce or widowhood. Stacy has over 20 years of experience in the financial industry. She attended the New York University Center for Finance, Law and Taxation, where she completed the Certified Financial Planner™ (CFP®) designation. Stacy is also a Certified Divorce Financial Analyst® (CDFA®) as well as a Certified Estate and Trust Specialist (CES™).

Stacy is the founder of Savvy Ladies™, a nonprofit organization dedicated to educating and empowering women and that has helped over 15,000 women make proactive choices about their finances. She is a nationally-recognized financial expert being one of twenty of the nation’s leading wealth managers on CNBC’s Digital Financial Advisor Council, a member of the Forbes Finance Council as well as an expert contributor for The Wall Street Journal. Stacy is the host of Financially Ever After, a podcast focusing on women, money and divorce.

Stacy has received numerous industry awards, among them, Investopedia 100 Top Financial Advisors, Investment News Women to Watch, Financial Planning Association’s Heart of Financial Planning Award, Financial Planning Magazine’s Pro Bono Award and the NAPFA Consumer Education Foundation’s first Pro Bono Award. She was also listed as a national Money Hero by CNN Money Magazine, one of the Top Wealth Advisor Moms by Working Mother Magazine and one of the best financial advisors for women by the Women’s Choice Award.

How to Protect Your Personal Finances in Divorce

by Stacy Francis, CFP®, CDFA

Divorces are very complicated and can take a huge emotional toll on you. The last thing you need is for your divorce to be a financial disaster, on top of that. One of the biggest questions divorcing couples have is “how are we going to split our assets?” Unfortunately, this is not easy to answer, as it varies from case to case, depending on state laws, the judge assigned and the specifics of each situation.

State Laws

Most states use equitable distribution to divide marital property. This method takes into account each spouse’s financial situation when dictating how to divide the property. This can add flexibility to the negotiations, but it can be challenging to anticipate what the outcome will be.

There are nine community property states (Louisiana, Arizona, California, Texas, Washington, Idaho, Nevada, New Mexico, and Wisconsin) that consider all property acquired during the marriage to be equally owned by each spouse, and it is split 50/50 in a divorce.

Determine Net Worth

To calculate your and your husband’s net worth, add up all your assets and then subtract all of your liabilities. Make sure you know the cost of your home and also have your house appraised, since the value may have gone up significantly since you purchased it. It is best to consult with a financial expert to help you assess the value of your investment accounts determining both their current and future values. Be sure to have any businesses or collections, such as fine art, appraised, as well.

Splitting Investments

Divvying up your stocks, bonds, 401(k) plans, IRAs, pensions, and other investment accounts can be a daunting task. The bottom line is the share of marital assets you get after the taxman gets his. Say your spouse handles all the investments and offers to split them 50/50. Sound fair? Maybe and maybe not. Be sure to look at the value of your assets relative to your spouse on an after-tax basis, and then decide if you like the deal. For example, some assets are taxed at a much higher rate than others, making them, essentially, worthless.

Many people are unaware that investment accounts have hidden costs like taxes and surrender charges that you need to take into consideration before liquidating or splitting them up. It is best to hire a financial professional to help you come up with a property division settlement; they will be able to help you see your whole financial picture while taking tax issues and future valuation of assets into consideration.

Some assets are more easily split than others. To get part of your spouse’s pension or 401(k), you’ll need a lawyer to draw up a qualified domestic relations order, or QDRO. There are several options, including a one-time payment, monthly payments at retirement, or a lump-sum payment that you would transfer directly into your own IRA, where your money would continue to grow, tax-free, until you retire. IRAs can be divided without a QDRO, as long as the division is explicitly detailed in your divorce agreement.

Long-Term Value

A key thing to keep in mind is to not give up long-term value for immediate gain. When looking at what assets you want to walk away with after this divorce, make sure you take into consideration the long-term value of these assets, not just the current value. If you give up a pension, for example, in exchange for keeping the house or up-front money, you may feel short-changed when you reach retirement age. A retirement account can be very valuable down the road.

Knowledge is Power

According to “The Divorce Revolution: The Unexpected Social and Economic Consequences for Women and Children in America,” a man’s standard of living usually increases by 10% after a divorce while a woman’s standard of living usually drops by 27%. They found that one of the factors in this is that women are more likely to be unaware of the family’s financial status. It is incredibly important to do the research on your financial situation, and fully understand it, so you will be better prepared when it comes time to negotiate your divorce settlement.

This article originally appeared on thriveglobal.com.

Stacy is a nationally recognized financial expert and the President and CEO of Francis Financial Inc., which she founded 15 years ago. She is a Certified Financial Planner® (CFP®) and Certified Divorce Financial Analyst® (CDFA®) who provides advice to women going through transitions, such as divorce, widowhood and sudden wealth. She is also the founder of Savvy Ladies™, a nonprofit that has provided free personal finance education and resources to over 15,000 women.