By Kelly Erb

When talk turns to taxes, it feels like everyone is filing a tax return—but do you need to? Here’s what to know about your tax filing obligations.

Who Needs to File Tax Returns?

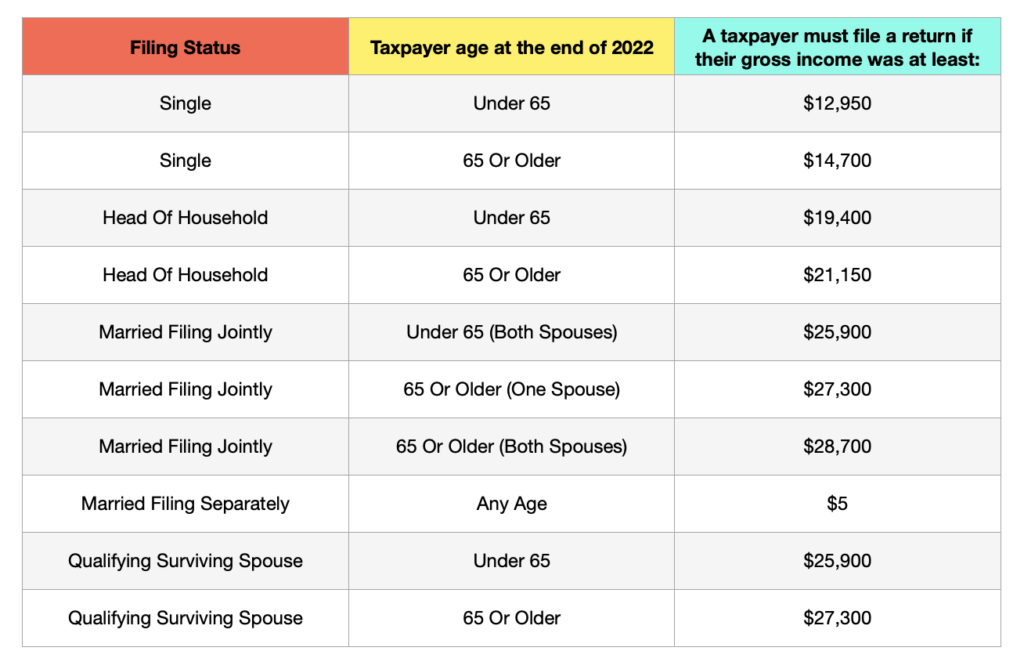

For most taxpayers, you can figure out whether you must file by checking the chart below. Choose your filing status for the tax year (left column), your age at the end of the year (middle column), and your gross income for the tax year (right column). If your gross income is above the threshold for your age and filing status, you should file a federal income tax return.

What’s Considered Gross Income?

For tax purposes, your gross income is all income you received that isn’t otherwise exempt from tax. Remember that if you are married and live with your spouse in a community property state, half of any income defined by state law as community income may be considered yours.

Find yourself without this chart? Here’s your quick cheat: The filing threshold is typically the standard deduction for your age and filing status—remember to consider the increased standard deduction for those over age 65 and/or blind.

Tax Dependents

It’s important to note that you can only use the chart if no other person claims you on their federal income tax return. If you can be claimed as a dependent on someone else’s tax return, the rules are a little bit different. Here are some basic guidelines:

- For single dependents who are under the age of 65 and not blind, you generally must file a federal income tax return if your unearned income (such as from ordinary dividends or taxable interest) was more than $1,150 or if your earned income (such as from wages or salary) was more than $12,950.

- For single dependents who are over 65 or blind, you generally must file a federal income tax return if your unearned income was more than $2,900 or if your earned income was over $14,700.

- For married dependents when either of you are under the age of 65 and not blind, you generally must file a federal income tax return if your unearned income was more than $1,150; if your earned income was over $12,950; or if your gross income was at least $5 and your spouse files a separate return and itemizes deductions.

- For married dependents when either of you is over 65 or blind, you generally must file a federal income tax return if your unearned income was more than $2,550; your earned income was over $14,350; and your gross income was at least $5 and your spouse files a separate return and itemizes deductions.

- These rules apply to dependents who are also married, not merely married taxpayers. For tax purposes, your spouse is never considered your dependent.

- A parent or guardian must file a tax return for dependents who are required to file but aren’t able to file for themselves.

Other Taxpayers Who Need to File Tax Returns

- Self-employed taxpayers with net earnings of at least $400;

- Taxpayers who owe special taxes like a recapture tax (such as the homebuyer’s credit), alternative minimum tax (AMT), household employment taxes, and taxes on tips you did not report to your employer;

- Taxpayers who received wages of $108.28 or more from a church or qualified church-controlled organization exempt from payroll taxes;

- Taxpayers who took an early distribution from a qualified plan or retirement plan, like an IRA; or

- Taxpayers who made excess contributions to an IRA or MSA.

Taking Advantage of Tax Breaks and Credits

Even if you don’t need to file a federal income tax return this year, you may still want to file to take advantage of tax breaks and credits. For example, you might be entitled to a refund for excess withholding or a refundable credit such as the earned income tax credit (EITC) or the child tax credit. You will only get a refund if you file.

Additionally, when applying for financial aid, students may need to provide tax account information from their tax return or their parents’ tax return. Timely filing means the information is readily available—the IRS Data Retrieval Tool allows you to transfer your tax information directly onto the online FAFSA form.

Don’t forget that reporting your income is important, especially for freelancers and self-employed taxpayers, because this information is used to calculate your Social Security benefit. You must report to get credit towards your Social Security retirement benefits.

One more thing: These rules apply to federal income tax returns, but the rules for your state or township might be different. You might have to file a state or local tax return even if you do not have to file a federal tax return.

If you’re still unsure whether you need to file a tax return, ask your tax professional, call the IRS (1.800.829.1040), or make an appointment to visit an IRS Taxpayer Assistance Center. You can also check out the Interactive Tax Assistant on the IRS website. It uses an interview-style format to help you decide whether you need to file—it’s anonymous and will not share, store, or use your information.

Have questions about your tax returns? Contact our Free Financial Helpline today and get matched with a financial advisor for pro-bono financial mentoring.

About the Author