by Suparna Bhasin, Founder of She Creates Change

One of my favorite sayings is “Money isn’t funny, people are funny with money!” What this means really is that we as a collective have made this thing called money mean so much about who we are, our level of success, a way to happiness and so much more. In reality, money is actually a neutral tool to buy and exchange goods and services.

What continues to surprise me is the amount of people that buy lottery tickets. I say this with a bit of tough love and smile on my face to anyone who buys lottery tickets – you are participating in the biggest scam in the world and p.s. money does not in fact buy happiness.

Money, however, is a ticket to freedom, which is what most people are truly seeking in their lives. So instead of a lottery ticket (let’s face it, it’s a long shot!) a more important investment is towards your time and imagination in considering what you would do with your life if you won the lottery. Money is simply a means to the end, NOT THE END!

I first taught my practices of Radical Financial Care in the summer of 2009, almost a year after we were on the brink of the total collapse of our financial markets. My belief is that this has happened because as a nation we held a very distorted view of money and its use in our society and culture: a mindset of over-consumption and greed.

The other observation I have made about money is the amount of fear our society has around making it, having it, and losing it. Many people make the most important decisions in their lives because of money and cause themselves an incredible amount of stress along the way. The biggest heartbreak I have observed is the abandonment of one’s dreams over money.

Debt is also an important and significant part of our monetary system. Many people believe that debt is bad just as many people believe money is the root of all evil as well as the source of happiness. Debt can be the result of money invested in opportunities, whether it be financial or towards your future dreams – this could be in a program such as She Creates Change, an advanced degree, a start-up business, property, etc. – anything you believe could give you a worthwhile return on your accruing the debt to begin with.

Debt when misused, can become problematic as can anything else. Often times people are unwilling to take risk in the form of investing their money as they fear that there will be no pay-off in the long run. Remember, money is an energy and tool – just consider how to use what you have or borrow in a healthy way that allows for advancement of your life and your dreams.

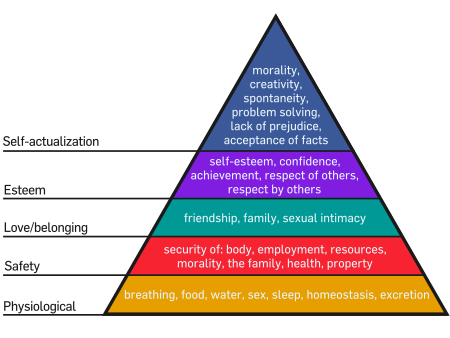

Now I would be misleading and misguiding you if I told you that money WASN’T important and that it did not have an important role to play in our lives and in your life specifically. We live in a material world wherein I believe it is critical to live responsibly with money and to create a healthy relationship with it and live comfortably without the stress it causes by not having enough to make ends meet. Personal development work is about actualization – according to Maslow’s Hierarchy of Needs (see graphic), it is impossible to thrive without first meeting one’s survival needs.

Together we can lay the foundation and blueprint for how you’ll make your dreams a reality. The first step is to concretely evaluate where you are today financially and work wise. Is your work sustainable? What will it take to move out of your current reality into your new one? Looking at your financial resources is an important part of this change.

It is important to “right size” money in your life. People in first world countries, such as the United States, typically have met their survival needs but often times at the cost to their health, relationships, and happiness. I ask you to take a very close look at your complete financial picture, income, balance sheet and finally the choices you are making to ensure they are the best choices possible for making your dreams a reality.