Balancing and understanding how to be savvy about juggling your money is essential in today’s climate when many businesses may be offering extensions to the monthly payments. Knowing what questions to ask, how to ask and confirming is going to be important and help you reserve your money today for the things you need first.

Take a deep breath. Recognize that you are not alone, and that you have the power to transform your financial narrative and situation now. While you may initially be feeling overwhelmed, even paralyzed and before you allow the internal loop of worry and angst to take over. Take a deep breath again. And then, another. Give yourself the gift of saying, “I got this, I am fearless”. And know that it is ok to ask for help.

The good news is that many of the creditors will be more than happy to extend your time to pay, or even strike deals with you so that payment is easier.

Here’s how to get started.

- Put a list together of all your credit cards that have a balance due

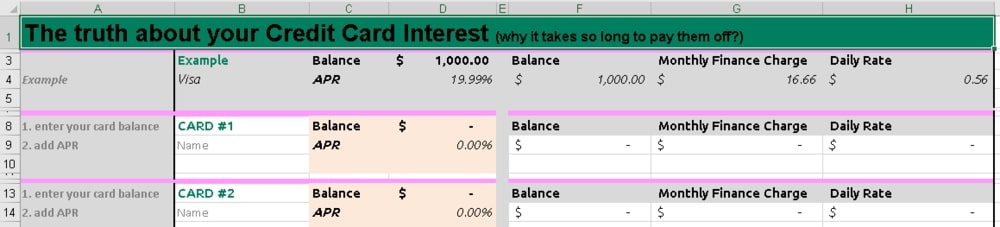

Document the balance of each card and its Annual Percentage Rate (APR) (the % of interest you are charged for your credit card purchases which accumulates daily). - Visit the website for your credit card company

The company website is your first best option to get the most updated information about your account and any relief the company is offering its clients. If you have not already created an online account, this would be a good time to do so. - Most credit card issuers are allowing delayed payments and waiving penalty fees.

However, pay close attention, most banks are continuing to charge interest on your balance. - Understand how much it will cost you to skip payments! Below is an easy Savvy Ladies Credit Card Interest Calculator to determine how much your credit card balance is costing you each month.

This is the time to conserve cash if you are, or will eventually struggle to pay your bills. Putting off credit card payments for 30-90 days is a reasonable strategy to maintain your cash saving now. Click on the image below to download the calculator.

Should you stop contributing to your retirement accounts during a volatile stock market? You’ve heard the adage “buy low, sell high” taking your money out of the market now is a panic strategy. You want to be ready to buy investments when they are on sale. Stay the course of your investment strategy and don’t let emotions and fear guide your decision making. Conventional wisdom: your retirement accounts should be a last resort for borrowing.

However The CARES Act, does allows you to withdraw up to $100,000 from a retirement account (IRA, 401(k), etc.) as long as you can prove that you need the money because of the pandemic, without a 10% penalty even if you are not 59½ years old.

You will still owe taxes on the withdrawal amount, but you can spread the tax bill over three years from the distribution date.

For example if you withdraw $30,000 and you are in the 24% tax bracket (30,000 x .24), you will owe $7,200 in taxes or $2400 per year for three years for taking your retirement funds as income. If you choose to repay yourself you’ll have three years from the day after you took the distribution.

For those of you that anticipate or are already struggling to pay your monthly rent, here are a few suggestions:

1. Make sure you communicate with your landlord and that you are transparent and honest about your economic issues.

2. If you have been furloughed or otherwise find yourself unemployed, be sure that you have proof of your unemployment to provide your landlord. The landlord will likely request documentation, be prepared to provide this information. Your landlord may also ask for a financial statement.

Continue reading here.

The Equal Employment Opportunity Commission (EEOC) continues to enforce the nation’s employment non-discrimination laws while ensuring that all of our activities are consistent with public health guidelines.

Is your debt a mindset or habit? What to do to pay off debt is not a secret: throw money at it until it’s gone. Dominate Your Debt® answers the trickier question …..How do I take control of my debt, pay it off on my own terms, and still live my life?”

This free on-line course will:

Give you confidence to confront your debt

Understand debt, repayment plans, and collections

Provide Tools and resources you can use to tackle your debt

How do I take control of my debt, pay it off on my own terms, and still live my life? Save your spot in our free Dominate Your Debt® online course

Most Importantly, forgive yourself for your present financial picture. Release your shame story knowing that you are human and perfectly imperfect. Today is the first day of the rest of your financial life. As you navigate forward, and engage on the path to financial stability you may experience a range of emotions. Hold on for the roller-coaster, and remain seated for the long-game.

Interestingly, the shame of not being financially savvy can interfere with your ability to change your circumstance. If you are feeling embarrassed or anxious by your lack of knowledge, that is okay. Notice how you feel and then allow the feeling to pass through you. Holding onto fear is not going to serve you.