By: Michelle Petrowski, CFP®, CDFA

Although not yet retired myself, years ago, when I was a young mother with 2 children under the age of 3, I became the caregiver to my dad, who was disabled in his mid-50’s. My parents had divorced after 30 years of marriage and they had no plan; as a result I became “the plan by default”, and as a result, this topic is one close to my heart.

The current landscape

“Baby Boomers” – consists of one of the largest demographic of citizens in history, whose oldest members began turning 65 in 2011, and according to the 2014 U.S Census bureau report “The Baby Boom Cohort in the United States: 2012 to 2060” thousands more are expected to reach age 65 daily until 2029 when the last boomer reaches this milestone. A later 2015 report cited that Senior consumers age 65 and older made up around 15% of the U.S. population; estimating that figure to increase to nearly 21% by the year 2030, and by 2060 to make up an estimated 24% of the population, which would include over 98 million individuals. Additionally, when examined, one finds that the age 85+ group is also driving the growth of the aging U.S. population and is projected to more than triple during this time frame from 6 million to 19 million according to the “Projections of the “Population by Sex and Selected Age Groups for the United States: 2015 to 2060”.

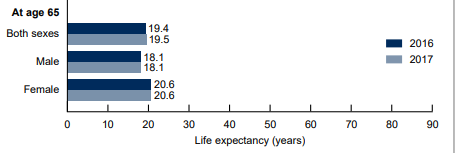

Chart taken from the “Mortality in the United States, 2017”, National Center for Health Statistics, Data Brief, November 2018.

So not only are the numbers of those over 65 increasing, but we are living longer due to advances in science and medicine. According to the 2017 “Mortality in the United States” report, life expectancy at age 65 was 20.6 years for females (age 85.6) and 18.1 years for males (age 83.1) , both unchanged from 2016. This makes cognitive decline, the detection of, and planning for even more important, as the likelihood that it will continue to increase and become a growing issue.

Let’s examine contributors to cognitive decline, some potential signs of, and ways we may prepare ourselves and our loved ones.

Longevity brings increased risks

As we age, we will undoubtedly face normal age-related changes, such as vision problems, hearing loss, slowed reaction time, and mobility issues. However, increased lifespan also brings the increased probability that we will develop a chronic condition, or even a physical or cognitive disability for which we will eventually need help. The US Department of Health and Human services estimated that 70% of all Americans over age 65 will require long term care services at some point in their lives, and that more than 40% will need care in a nursing home.

According to the 2020 Alzheimer’s Disease Facts and Figures:

-

“.. an estimated 5.8 million Americans age 65 and older are living with Alzheimer’s dementia in 2020. Eighty percent are age 75 or older.”

-

“Almost two-thirds of Americans with Alzheimer’s are women”

-

“By 2050, the number of people age 65 and older with Alzheimer’s dementia may grow to a projected 13.8 million”

This is just Alzheimer’s and doesn’t address the many other causes of diminished mental capacity resulting from various conditions and illnesses such as stroke, traumatic brain injury and dementias (including Alzheimer’s). These are surely numbers we need to pay attention to from a planning and risk management perspective.

These changes create challenges and risks for those afflicted by them, family and even service professionals that work with them. There are professional and ethical challenges presented as one’s ability to make sound financial decisions may become impaired. Consequently, those that experience a decrease in mental capacity are at greater risk of having lapses in judgement, making unwise financial decisions and becoming victims of financial abuse.

Potential signs

There are normal parts of aging and then are those that are not, and they may vary considerably from one person to another.

Some common forms of age-related cognitive decline:

-

decreased speed at which one can process information

-

some loss of capacity to draw inferences from information

-

loss of ability to multi-task

-

memory lapses from time to time

-

decrease in the ability to focus

Cognitive changes such as these are normal and not necessarily indicative of any form of dementia, nor do they mean that seniors are any less smart than their younger counterparts. These changes can also be exacerbated by, or can be the result of inadequate diet, vitamin deficiency, improper medication dosage, insufficient sleep, isolation or depression to name a few.

A few potential “red flags” to cognitive decline:

-

diminished capacity – including the inability to process “simple” concepts or answer verification questions, not knowing the day or time, inability to understand the consequences of decisions

-

difficulty speaking or communicating

-

visible mood and personality change, disorientation with his or her surroundings or social settings, uncharacteristically unkempt or forgetful.

-

demonstrated erratic behavior compared to previous behaviors for that individual, such as :

-

decisions that are inconsistent with current long-term goals or commitments

-

anger or irritation when presented with recommendations that are in keeping with agreed-upon plans

-

refusal to follow appropriate financial advice

-

difficulty signing his or her name to a check or other document

-

concern or confusion about “lost” or “missing” funds when there have been no unauthorized money movements or no movements at all

-

a lack of awareness of, or understanding of recently completed financial transactions

Let’s face it, any one of us can have an accident or become ill and be unable to make medical or financial decisions for ourselves , or cognitive changes can also be indicative of more severe impairment that at some point CAN diminish or erode functionality.

What can YOU do?

Work with a professional and HAVE A Plan! Here are some tips…

-

Have these conversations now with family, and your trusted financial advisor (if you have one) BEFORE this is an issue. Rehearse what that plan will look like under different scenarios, so there is a common understanding.

-

Sign an agreement with your financial advisor ahead of time on what will happen if cognitive incapacity or financial fraud is suspected; defining who will be contacted and when.

-

Consider pros & cons of various strategies including appointing someone trusted to act on your behalf when you still have the mental and physical capacity to do so, and planning tools such as:

-

powers of attorney (POA) – consider adding an extra layer of safety by having your agent meeting periodically with an independent 3rd party to ensure your assets are being used for your benefit

-

understanding how to protect against guardianship & conservatorship & when & how it may be initiated

-

co-owned accounts

For more information on planning tools and the obligation of financial professionals, you can check out ”Steps to Protect Those with Diminished Mental Capacity from Elder Financial Abuse”.

-

Let your trusted Financial Advisor know

-

whose is titled on your accounts

-

the names of other important professionals; attorneys, accountant. CPA, Tax/Insurance professional etc.

-

the existence of documents such as POA, HC proxy, a will, who has copies of them and who are the important people named in these documents. Share them with your Financial Advisor if you are comfortable

-

-

Have a trusted person meet your financial advisor – that way you have a team looking out for you in case of decline, there’s a plan, and there is less likelihood of someone stepping in that might not have your best interest at heart.

-

Increase your financial literacy, so that you can make important financial decisions. Check out resources available at;

-

Consumer Financial Protection Bureau

-

Maintain a regime of healthy thinking skills such as puzzles, memory games. Engage in regular exercise, and spending time with family/friends, and eating healthy.

This is by no means meant to be an exhaustive discussion on the topic; but rather food for thought and consideration. Honestly, it will never seem like the “right time” for these conversations. Take action before an accident, injury, or age makes it impossible to make your wishes formalized with a plan.

This article was originally published in “The Street”

Michelle Petrowski is the Founder of Being Mindful in Divorce. She’s a divorced single mom, passionate about using her professional experience as a CFP® & CDFA™ and personal journey to support women in transition; creating confidence through education so they can make financial choices with peace of mind. Bringing together a background in investment management, tax prep and retirement planning, to provide Divorce planning (with singles or couples) and Financial Coaching services, financial literacy workshops and writings.