Breaking the silence around money and equipping women with the tools to have open, honest financial conversations are at the core of the Savvy Ladies mission. That’s why this summer, we asked our community how they really feel about money conversations. Through a survey of our Helpline clients and webinar attendees, we uncovered valuable insights into the emotional barriers and motivations surrounding money conversation.

What Research Says About Women and Money Talk

National surveys show that for many women, money remains one of the hardest things to talk about. A 2023 Wells Fargo study found that most people consider money harder to discuss than politics, religion—or even death. Women were more hesitant than men in nearly every category, and half of the women said they avoid money talk because it feels too personal.

The 2024 Her Money Mindset survey revealed that even among friends, women tend to keep financial details vague. Only one in four feel comfortable sharing how much they earn. Other studies echo this trend: Bank of America reported that 40% of women feel embarrassed talking about money with family or friends, while Age Wave found that 61% would rather talk about their own death than their finances.

Despite growing interest in financial education, many women are still held back by long-standing taboos and a lack of safe, supportive spaces to talk.

What Our Community Told Us: The 2025 Savvy Ladies Money Talk Survey

To better understand the experience of women in our own community, last August Savvy Ladies conducted a survey on money conversation. We polled women who had actively engaged with our Free Financial Helpline or participated in our workshops. Their responses revealed how motivated women in the Savvy Ladies community are to break the silence around money and expand their financial education.

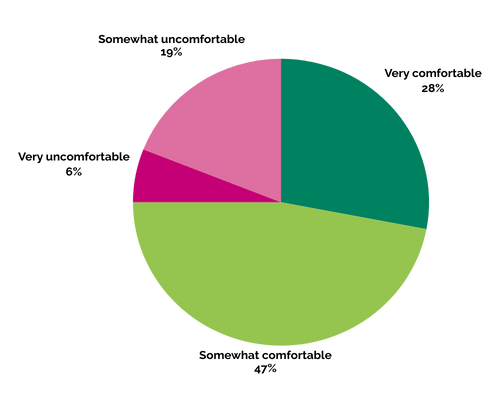

How do women feel about money conversations?

Most women surveyed–75%–say they feel somewhat or very comfortable discussing money. One in four still report discomfort, showing that there’s still work to do in helping women talk freely and confidently.

What are the main barriers to talking about money?

When we asked what typically holds them back, the most common response was feeling uncomfortable about income differences. Nearly half of the respondents cited this as a barrier. Fear of judgment, shame, and embarrassment came in a close second. Many women also pointed to trust issues, concern about being taken advantage of, and growing up being taught that money is a private topic. In contrast, only 13% feel that finances are too complex of a topic to discuss, suggesting that the barriers lie more in emotional discomfort than in a lack of capability or confidence.

| Income level differences | 48% |

| Shame, embarrassment or fear of being judged | 46% |

| Don’t know who to trust | 32% |

| Don’t want to be taken advantage of | 27% |

| It’s a private topic | 26% |

| Quality of the discussion | 22% |

| Grew up being told never to discuss money | 19% |

| It’s too complex a topic | 13% |

| Other | 10% |

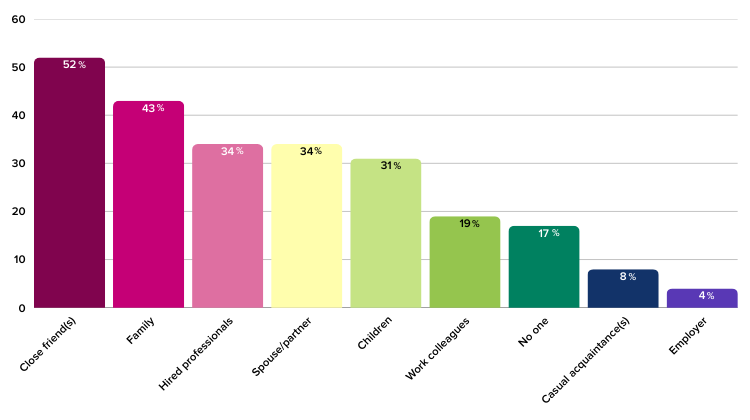

Who are women having money conversations with?

Close friends and family were named as the most common confidants when women do decide to talk about finances. Overall, only a third of the respondents said they discuss money with their spouse or partner. Among married respondents, 76% discuss money with their spouse, and 24% consult with hired professionals. Single (never married) and divorced respondents, rely more on close friends (65% and 55% respectively, compared to 32% of their married counterparts) and on hired professionals (39% and 38% respectively). A significant 17% said they don’t talk about money with anyone at all. Only 4% of all respondents discuss money with their employer.

What motivates the women in our community to push past the discomfort?

In short: the desire to feel informed, confident, and empowered. When asked what they hoped to gain by having open and honest money conversations, the majority of respondents said they want to better understand their financial options and learn more about investing. Others expressed interest in improving their mindset around money, gaining clarity on long-term wealth building, and feeling less alone in their financial journey. Many also hope to pass financial confidence on to their children.

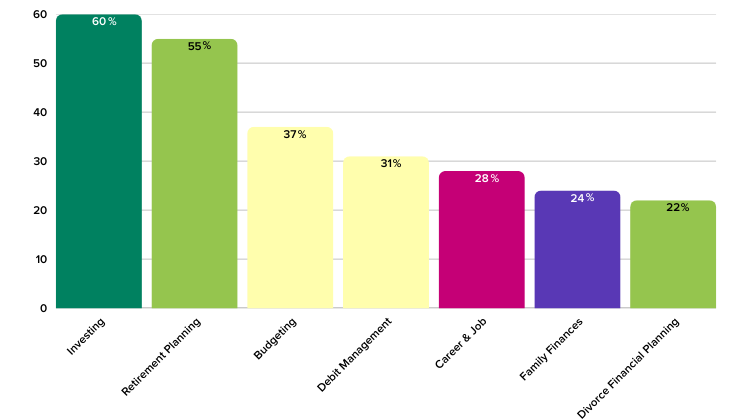

When asked what topics they most want to discuss, investing and retirement planning topped the list, followed by budgeting, credit and debt, and career growth.

What do you hope to gain by having open and honest money conversations?

| Learn about financial choices | 69% |

| Enhance my investing knowledge | 67% |

| Grow my financial confidence and motivation | 55% |

| Create a healthier money mindset | 53% |

| Understand long term wealth building | 52% |

| Feel less alone in my financial journey | 49% |

| Ensure my children are financially savvy | 40% |

| Initiate conflict-free family estate planning | 28% |

| Boost my career and job opportunities | 28% |

What money topic do you most want to talk about openly and honestly?

Key Takeaways

- Women in the Savvy Ladies community show a higher level of comfort and confidence having open money conversations compared to nationwide studies. With 75% feeling very or somewhat comfortable speaking about money, they show they are motivated and ready to take charge of their financial future.

- With only 13% stating that finances are too complex of a topic, most women feel confident in their own ability, but they do fear judgement, shame and embarrassment, lack trustworthy interlocutors, and point at income level differences as the top obstacles to having money conversations.

- Women are most likely to talk about money with close friends and family, though patterns vary by relationship status—married women lean on spouses, while single and divorced women turn to friends and professionals. 17% don’t talk to anyone at all.

- Most women in the Savvy Ladies community want to break the money silence in order to gain financial knowledge and more confidence, cultivate a healthier money mindset, and feel less alone. Investing, retirement planning and budgeting are the top interests.

Why Money Conversations Matter

When women feel comfortable discussing their finances, something powerful happens. It reduces feelings of shame and isolation, helping to break the silence that often surrounds financial stress. Money conversations also strengthen relationships. Whether with a partner, parent, friend or child, being open about finances helps align goals and reduce conflict.

Most importantly, talking about money builds confidence. With every conversation, finances feel less intimidating and more manageable. That confidence leads to action—whether it’s starting to invest, negotiating a raise, or planning for the future with greater peace of mind.

Join the Savvy Conversation

At Savvy Ladies, we believe that every woman deserves a safe, supportive space to talk about money without fear or shame. That’s why for over 20 years we’ve been building a community where women across the country can find judgement-free and expert financial guidance at no cost.

The Savvy PledgeTM invites you to take the first step by committing to one open and honest money conversation. In return, you’ll be invited to a Money Conversation Circle: a supportive, virtual gathering led by Savvy Ladies Founder Stacy Francis, where participants explore financial topics together and begin rewriting their money stories.

If you’re seeking one-on-one guidance, ask a question on our Free Financial Helpline and get matched to one of our volunteer financial experts who provide personalized, judgment-free support. After using the Helpline, 76% of women report a significant reduction in financial anxiety, and 80% say they feel more confident managing their money.

Our broader programming includes free virtual workshops and sessions, free online courses, a financial wellbeing workbook, and a robust library of articles and recorded sessions designed to meet women where they are and guide them where they want to go.

Let’s replace shame with knowledge, fear with confidence, and isolation with community. The women in our community are ready. They’re motivated, asking questions, seeking support, and having brave conversations that are changing their financial futures. If you’ve been waiting for the right moment to talk about money, this is it. And Savvy Ladies is here to help you every step of the way!